Indian Tax department sent notices to big pharma companies for not cutting Goods and Services Tax(GST) on free goods or samples to the retailers. With regard to this notice, tax experts warned other fast-moving consumer goods (FMCG) companies that they can also be affected by this move as there is no ground for the notices.

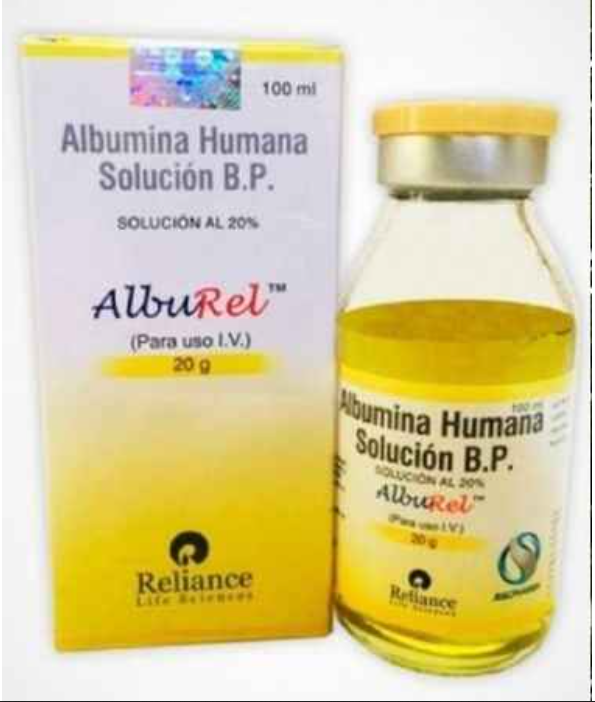

DGGI(Directorate General of Goods and Services Tax Intelligence) said in the notice that it has been found that some of the free supplied drugs – injections, tablets, syrups – have been made to stockists and retailers without charging GST on them.

Abhishek Rastogi, partner with Khaitan & Co said that this issue of GST on free supplies will have wider implications scope that can affect many sectors, including FMCG and apparels. This simply means that the implications could arise whenever discount is offered by way of a quantity discount.

He also shared the predetermined discounts offers factored in the invoice or by way of an agreement should remain out of the GST net. In these cases, it is just the valuation mechanism to provide for a value of more than one product sold as a bundled supply in more than one pack, experts said. Further, free supplies can be taxed only when the transaction happens between two sets of persons specified under the law, such as related persons, principal, and an agent. The section 15 of the Central Goods and Services Tax (CGST) Act says the value of the supply of goods or services or both shall be the transaction value, which is the price actually paid or is payable for the said supply where the supplier and the recipient are not related and the price is the sole consideration.

The section also says the value of the supply shall not include any discount which is given before or at the time of the supply if such a discount has been duly recorded in the invoice issued in respect of such a supply. For this purpose, such discounts have to be established in the terms of an agreement. Rastogi said such free supplies have been, historically, excluded from the value of taxable supplies under the erstwhile tax system. The notices sent by the directorate general also point out that the value of such free supplies has been realized by the ultimate consumer. Rastogi said the sale in the aftermath of the supply against which notices have been sent has no relevance.